Outstanding Info About How To Find Out If You Are In Collections

Reconcile the information on your credit reports with what you found in your records and from the original creditors.

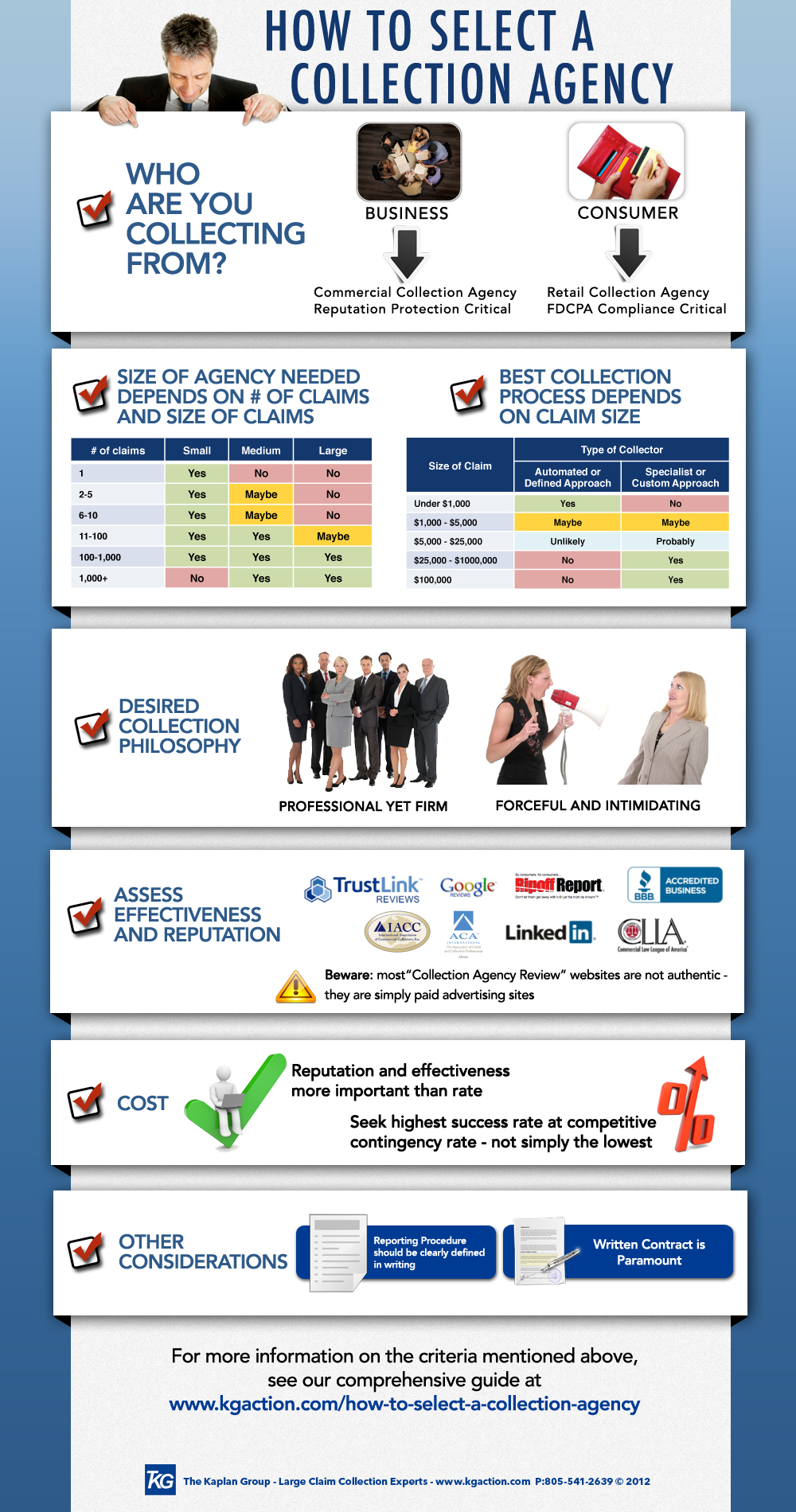

How to find out if you are in collections. You also can locate a collection agency with just the. Start by asking the collection company what its records show about when you made your last payment. Contact your loan holder to ask about your options or to find out the contact information for their collections agency.

Notepad++, visual studio code), search against. Legitimate debt collectors will leave a voicemail and contact information if they cannot reach you directly on the phone. Obtain contact info of the collection agency from your credit report.

When you have that information, contact your state attorney general’s. You can obtain a free credit report from each of the three major credit bureaus—. However, it is possible you might be.

Finding out if you have an account in collections is simple: How to find out if you have accounts in collections typically, the collection agency will try and contact you and notify you of the collection account. A telephone number is also provided with each.

Finally, using the power text editor of your choice (e.g. Collection agencies are not required to report their. The first thing to do to find out if you have debt in collections is review your credit report.

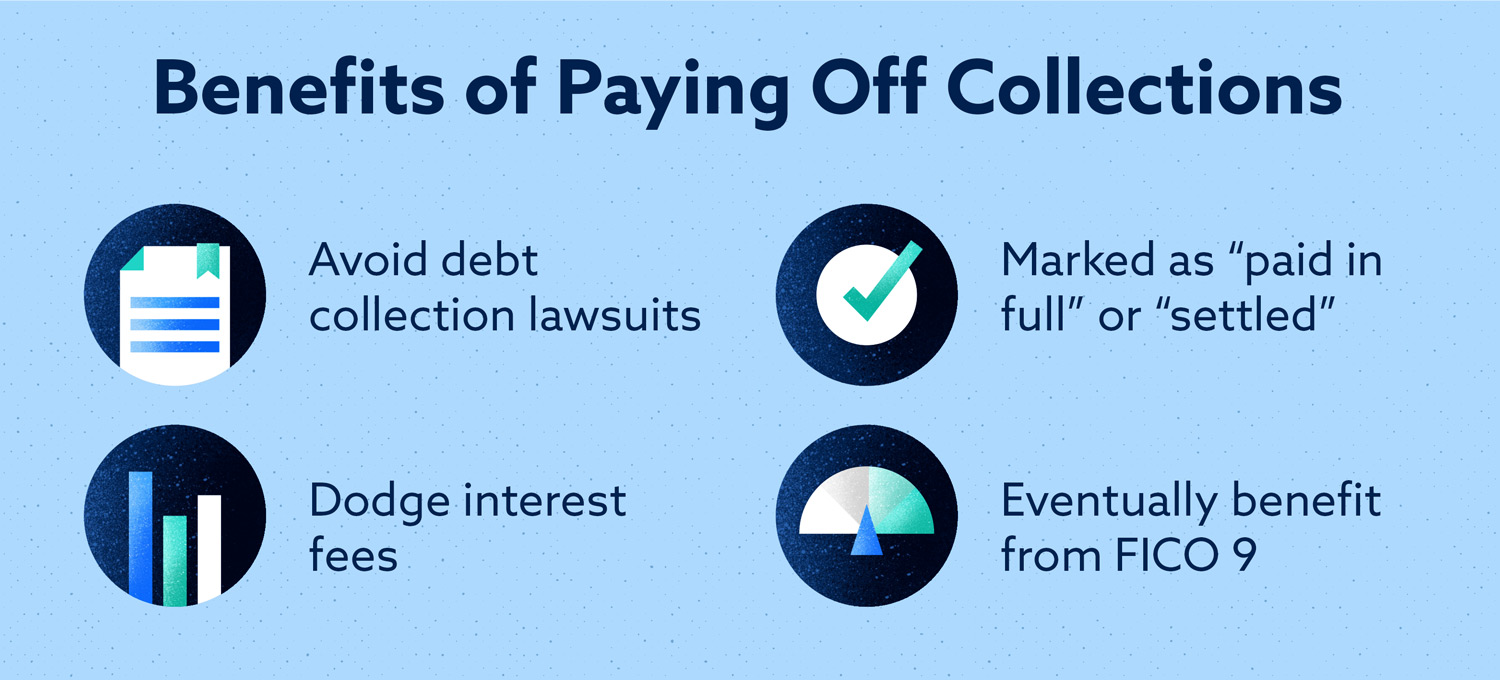

Catch up on payments quickly catching up on. They likely won’t be able to discuss your debt with you after it’s been sent to collections. To find out what you have in collections, you will need to check your latest credit reports from each of the 3 credit bureaus.

/how-can-i-find-out-which-collection-agency-i-owe-960657_final-d78530899b944be6a726b81a4e32ffa5.png)