Looking Good Info About How To Deal With Credit Card Debt

See how much you could save on your debt!

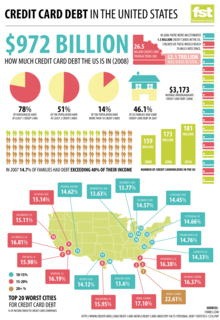

How to deal with credit card debt. You’ll generally pay about 20 percent (or more) of your balance in fees, or $2,000. On the first front, red suggests people cut up all but one of their credit cards. Get your free quote today.

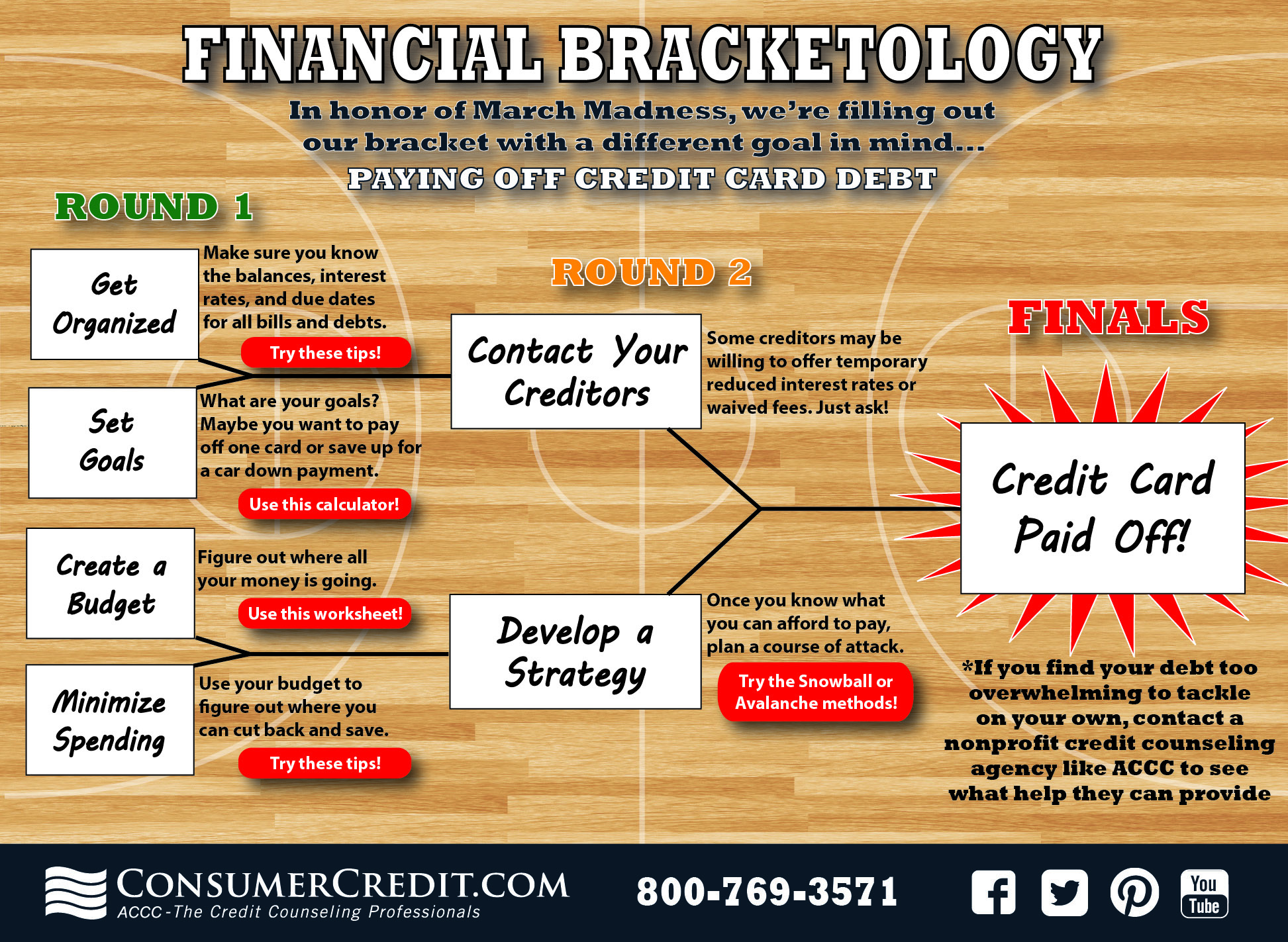

Ad view editor's #1 pick. Seek help (if you need it) 7. Dealing with credit card debt is never easy.

How to get out of credit card debt 1. Afcc & bbb a+ accredited. Rated #1 by top consumer reviews.

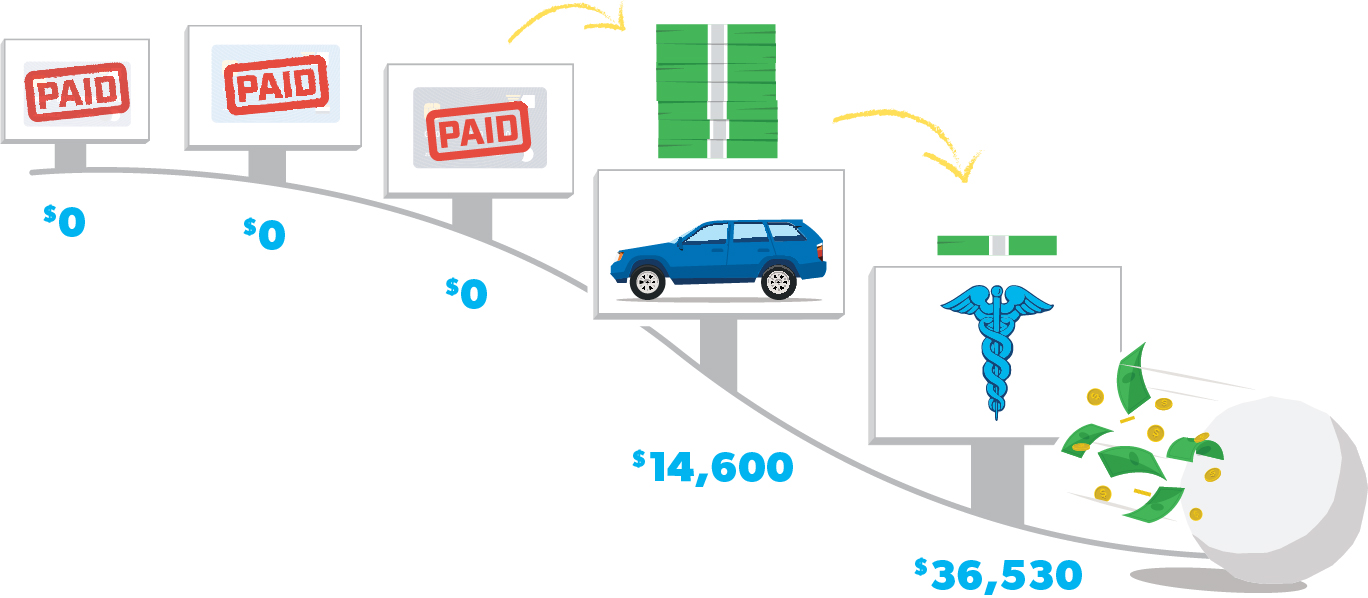

Ad compare 2022's top 5 debt consolidation options. Firstly, you could transfer your existing debt to a 0% balance transfer card and put off paying interest for a time while you make up the cash necessary to pay it off. Our certified debt counselors help you achieve financial freedom.

Ad free independent reviews & ratings. See how much you could save on your debt! Don’t cancel the accounts because your credit score will suffer.

If you have debts on more than one credit card, start by paying the smallest balance off first. Dealing with credit card debt may be easier than you think. Do not try to avoid claiming this as the.